We’ve all done it. Either by error or being over zealous and getting ahead of ourselves. I’m talking about creating invoices for potential and existing clients when payment for services have not been agreed or finalised.

Well, now with the latest Sliptree update we have some awesome new features that we know you’ll love to make your workflow even more straightforward.

We all want our invoices to be paid, but at times we make errors and the invoice is no longer required. Within Sliptree you can edit or delete your invoices anytime. Yet previously, when you deleted an invoice we archived it to the trash bin – why? Well a couple of reasons:

- First, deleting an invoice would create havoc with future invoice numbers as there would be a gap in your invoice numbers, so we merely ‘archived’ the invoice so that your invoices run in sequential order.

- Second it could have legal ramifications in some countries. Deleting invoices is a way to ‘hide’ payments so the team felt concerned about how this could impact you.

Yet, we are always looking at better ways to streamline your workflow and with the latest update you can now fully delete your invoices, estimates, items and documents should you require. Because of the legal point mentioned above we’ve added a brand new feature. Why not convert your invoices to credit notes instead?

Credit Notes

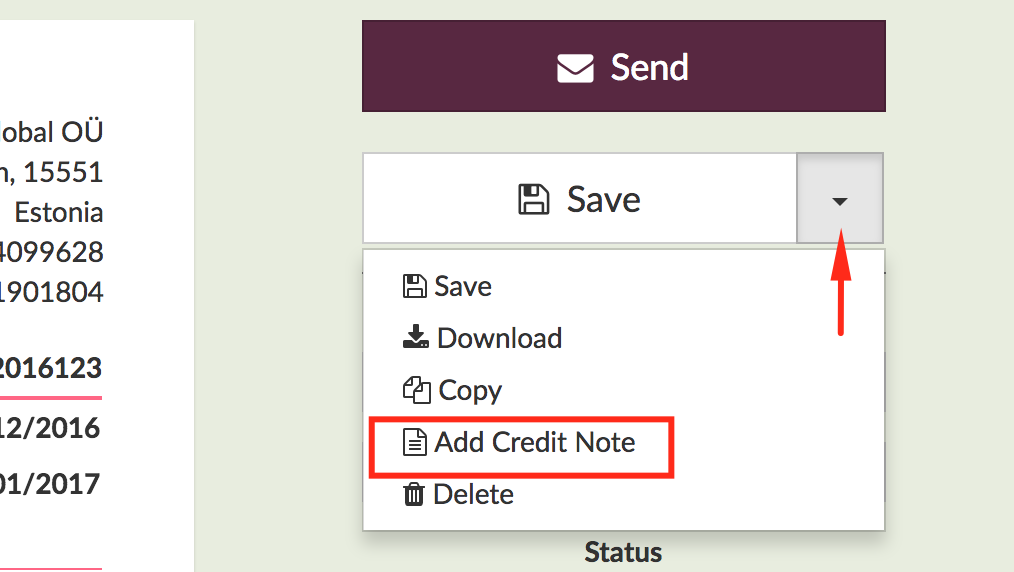

You can now create credit notes from existing invoices. Simply click on the Add Credit Note link from invoice list, or create a new invoice and enter a negative amount – the invoice will automatically be converted to a credit note. All previous invoices with negative amounts have now also been converted to credit notes.

It’s simple: select the dropdown box on Save > Add Credit Note in the top right hand corner of your invoice and it’s done!

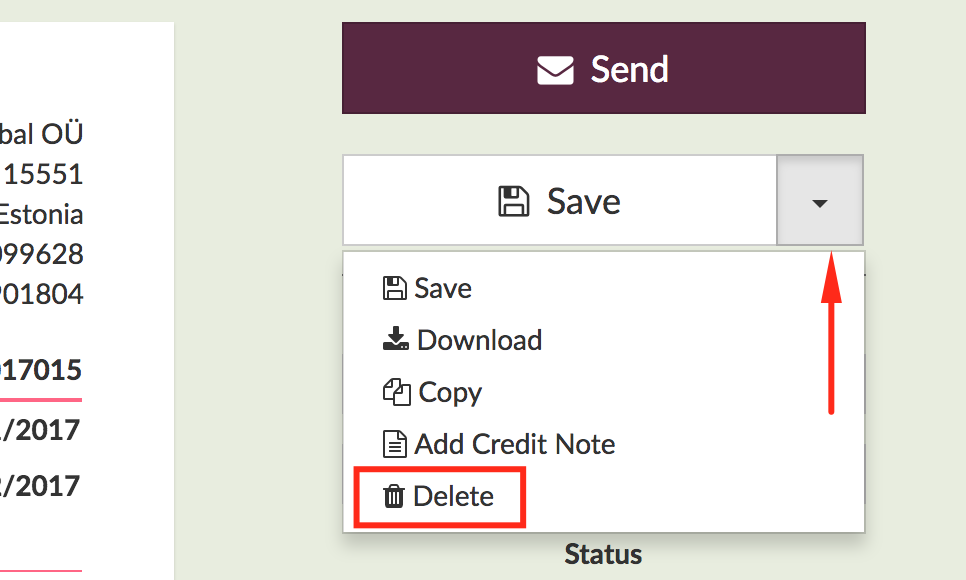

Still want to fully delete?

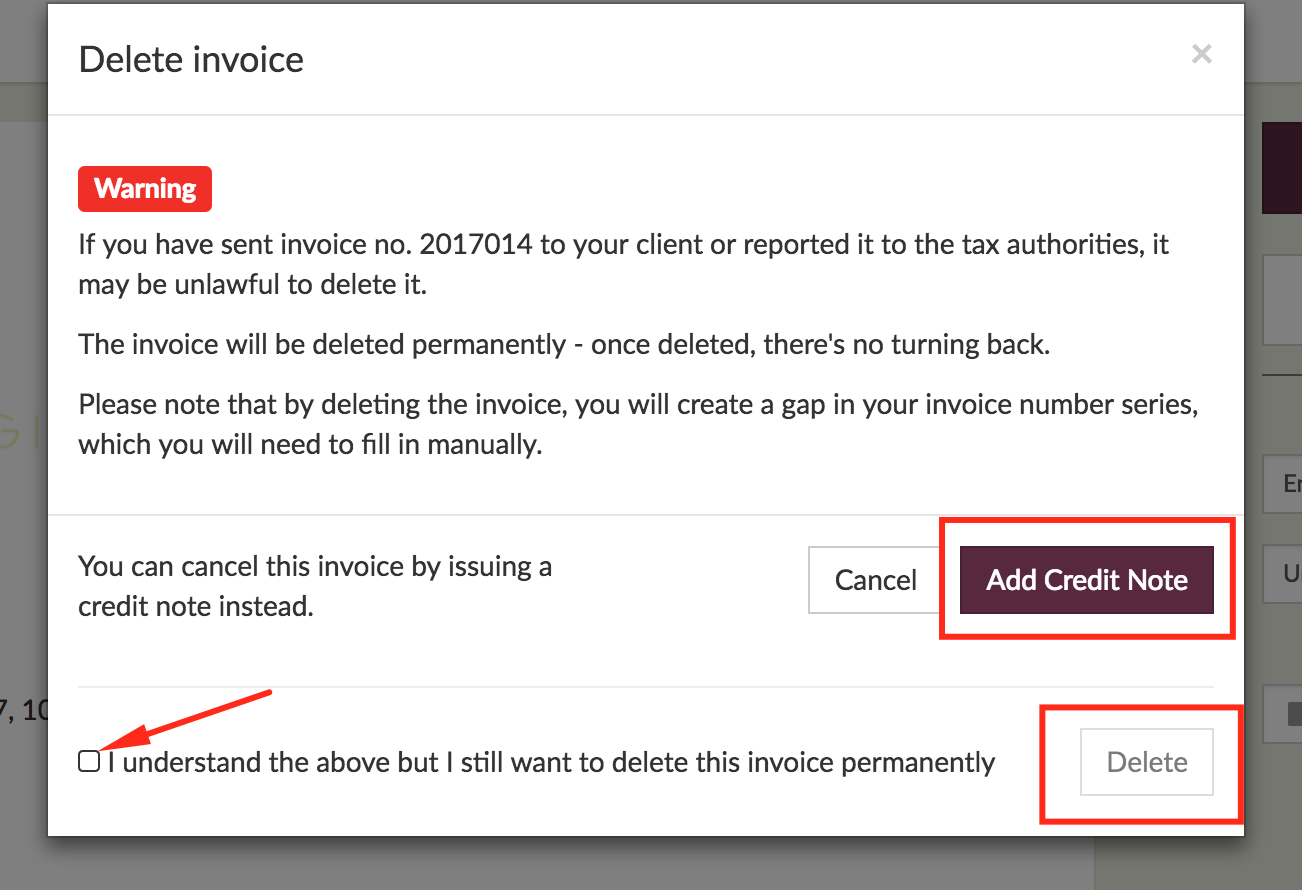

Sure, no problem. We’ve implemented a full delete to your invoices. Click on the Save button dropdown and hit Delete and this starts the process.

You will see a big modal window with a warning that it may be unlawful to do so, and again we’ll suggest creating a credit note instead. If you still want to proceed then simply check the checkbox advising you understand the possible implications and hey presto! It’s done!

And what else is new?

Glad you asked! Well you can add or edit taxes from the organisation preferences screen, setting which default tax rate you require most for your invoices.

Head to your organisation in the top right hand corner, then Organization settings > Preferences > Scroll down to Taxes and check the box and select your default rate.

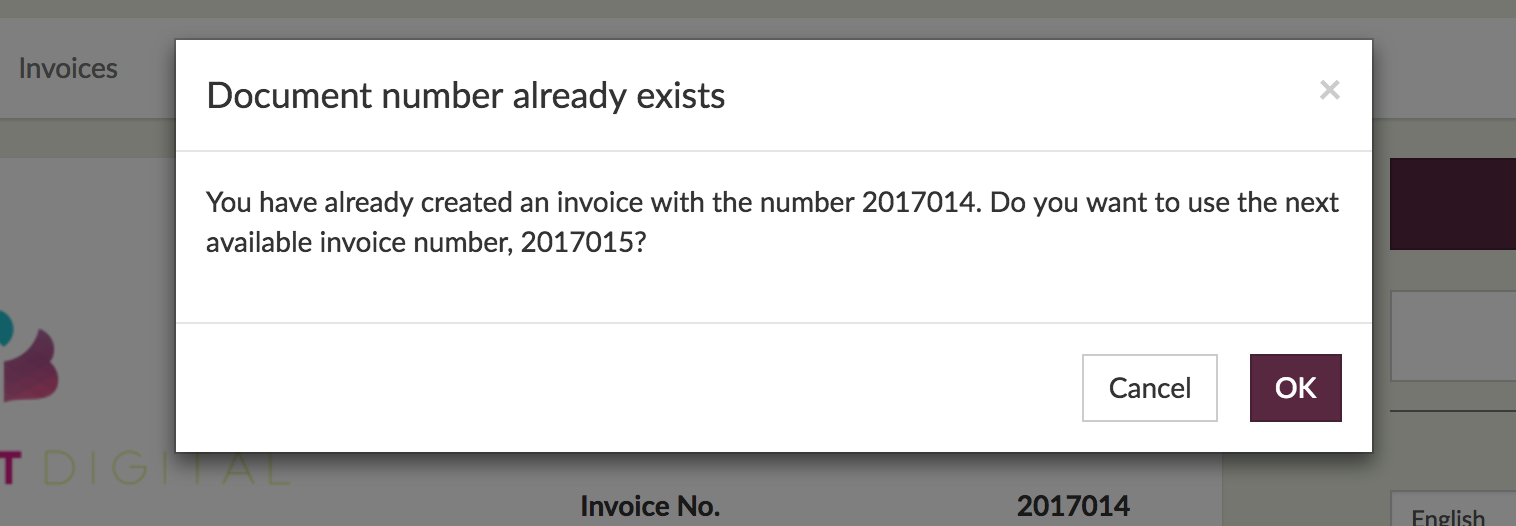

Avoiding invoice number duplication

When you create invoices and estimates with a number that’s already in use, Sliptree will now advise you of the best next number to use, enabling you to keep your invoices in a nice and sequential order.

Tip: Certain countries require invoice numbers to be sequential by law – avoiding invoice number duplication helps you meet your legal requirements.

Quick Recap:

- You can now create Credit Notes instead of invoice deletion

- You can fully delete invoices (used to be archived)

- Set your default Tax rate on your invoices

- Sliptree suggests which invoice number to use next to keep everything in order

We know these features will streamline your workflow but should you have further questions, simply ping us a message at support@sliptree.com